- Seventy-three percent of roughly 200 investment professionals in Shanghai and Beijing said in August that they predicted positive returns for mainland Chinese stocks, a J.P. Morgan survey showed.

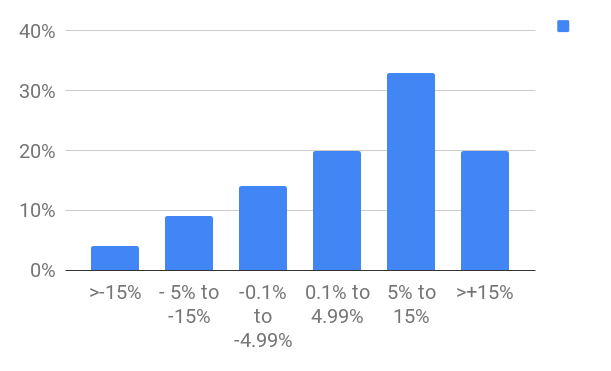

- One in three, or 33 percent, forecast gains of 5 to 15 percent domestic stocks, known as A shares.

- The recent market drop has brought down the price of some good quality companies to a more attractive valuation, according to Eric Bian, investment specialist at J.P. Morgan Asset Management.

A majority of mainland Chinese investors expect the battered local stock market to rise over the next 12 months, according to a J.P. Morgan Asset Management survey released Monday.

The Shanghai composite is one of the worst performing stock indexes in the world this year. In June, the index fell 20 percent from a recent high, or into bear market territory. It remains more than 15 percent lower for 2018, hit by investors’ worries about a slowing Chinese economy, authorities’ efforts to reduce reliance on debt-fueled growth and rising trade tensions with the U.S.

In contrast, U.S. stocks are at record highs.

Despite the Shanghai market’s drop this summer, 73 percent of roughly 200 investment professionals in Shanghai and Beijing said in August they predicted positive returns for domestic stocks, known as A shares, the J.P. Morgan survey showed.

Investor predictions for the performance of Chinese stocks over the next 12 months

One in three, or 33 percent, forecast gains of 5 to 15 percent. Slightly more, or 38 percent, expect global stock markets to rise by the same amount over the next 12 months, and a total of 67 percent predicted overall gains. The survey covered representatives from onshore fund distributors, including financial advisors and investment consultants, according to J.P. Morgan.

The recent market drop has brought down the price of some good quality companies to a more attractive valuation, according to Eric Bian, investment specialist at J.P. Morgan Asset Management.

While he would not disclose specific names, he said there are now buying opportunities in some health care and consumption stocks. In health care, the sub-industries range from drugstores to biotech, and, in consumption, tourism-related names are more attractive, Bian said.

A vaccine scandal in July hit health care stocks across the board. The sector is among the worst performers in the Shanghai composite over the last 60 trading days, down 20.5 percent. But Bian said the sell-off created good buying opportunities in some companies that can grow and gain market share over the long run.

Still, health care is down 7.8 percent for the year so far, making it the best performing sector in the Shanghai composite.

Bian also said there are some attractive mainland stocks in automation and software, especially given expectations that Chinese companies will soon increase their spending on enterprise software.